“Being the richest man in the cemetery doesn’t matter to me… Going to bed at night saying we’ve done something wonderful… That’s what matters to me.”

Steve Jobs

If you want to achieve something big, owning things can hold you back. The bigger your house, the greater the number of cars you have, the more the maintenance and ownership of such things can prevent you from achieving your goals. All this takes away the very thing we need most. Time!

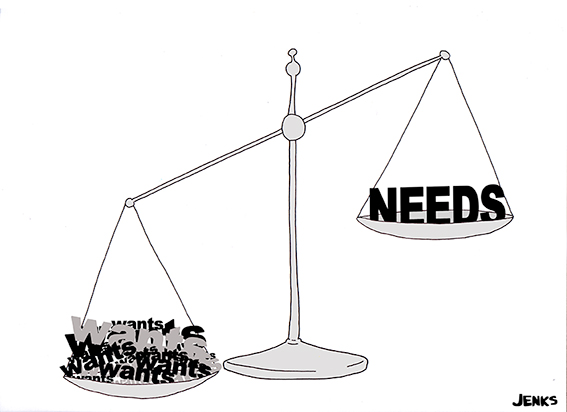

So many people work long, hard hours to make more money at the expense of spending time with family, getting a good night’s sleep, or being healthy and relaxed. But there comes a point when striving, earning or acquiring money is actually counterproductive – and when having more money just doesn’t make us any happier!

All the evidence suggests that the more money a person makes, the more their expectations and desires rise – and because they want ‘more’, there is no long-term increase in happiness. The happiness they crave is always out of reach. In the late 1990s, psychologist Michael Eysenck used the phase ‘hedonic treadmill’ to compare the pursuit of happiness with being on a treadmill: running fast and working hard, but still staying in the same place.

But psychologists’ assertions that there’s a ‘Hedonic (or Happiness) Set Point’ suggests that our happiness is more like a thermostat, since we seem to always come back to a certain default setting in our happiness level. Good and bad events may alter our level of happiness temporarily, but in the long run, we simply adapt to any changes, and our level of happiness tends to adjust back to our old default setting.

Although people earning a good living are often happier than those who don’t, once you have already reached a standard where you have what you need to function and to be contented, earning extra income will not lead to extra happiness.

Since there is clear evidence that money doesn’t buy happiness, let’s free ourselves from striving for more money by making the most of what we have, and being happy now. Work out where your happiness set point is, then work out the minimum you need to earn and to have, to keep you happy. Know your ‘minimum wealth’ point, and you can set about increasing your happiness in other ways that really work. This might take a change of mindset, but then you can live the life you’ve always wanted – now.

Read my blog on the Happiness Advantage

Are you on the hedonic treadmill?

Do you want more, in material terms?

How long does your happiness last, after certain purchases?

What setting is your happiness thermostat on?

Do you know where your ‘hedonic set point’ is?

Let’s reach that ideal – yet realistic – level of hedonism without paying such an expensive price. Here are some great solutions to get you off that hedonic treadmill:

1. Know Where You are Going

It’s really important to know what you’re aiming for, for everything else to fall into place. What is your goal, or your envisioned destination in life? Ultimately, what are you making money for? And how does your spending help you to achieve that?

Discovering this early on can literally save you decades’ worth of hard work!

Read my blog on The ultimate shortcut to an ideal life.

2. Service Your Life

Time is money, and money can buy you time. Invest in one, and you’ll get more of the other, to create a more enjoyable and meaningful life. Look at your money and decide where you should be investing in freeing up time; then invest that time on the things you want to do.

How do you buy yourself time? First of all, do less. Eliminate what is unnecessary and isn’t helping you get to where you want to go. Hire good people, like people to run your business, or a driver, assistant, travel agent, cleaner, laundry service etc.

Apply the same entrepreneurial skills and innovation to your personal life as you do to your work life. The trick is to own fewer assets that take up your time, and invest in services that give you time.

Live the 4 steps to freedom

3. Apply the 80/20 Rule

The Pareto Principle – the 80/20 rule – states that 80% of our outputs are created by 20% of our effort. It never fails to amaze me, but this rule can be applied to virtually every area of life!

For example, consider which 20% of your possessions give you 80% of the benefit.

Make decisions based on the amount of time, effort, money and benefit, while remembering this rule. Is extending your house to create another spare bedroom or a formal dining room worth it, given the hassle of creating and maintaining it? What’s the smallest space you can live in, for the majority of your day-to-day requirements? How can you apply this rule to your life? The time and cost benefit of doing this could be staggering.

Live by the 80/20 Rule

4. Don’t buy – rent!

This might go against everything we have been taught growing up. But let us not forget that these old beliefs come directly from the heart of the hedonic system that values money over and above time!

Look at the opportunity cost of ownership. This is the the sacrifice you make in choosing between options. For example, the opportunity costs of owning a luxury car are the spare cash and the benefits of spending the money on other things to enhance your life – like a holiday or taking an extra day off each week to spend with your family. Remember the time and resources you lose in maintaining your possessions – like the garage and cleaning costs. Opportunity costs are not just financial: but also include the real cost of lost time, pleasure or any other benefit.

Most things can be rented, so there’s no need to own. Think about renting rather than buying, because there is a short lifespan to enjoying things (the novelty soon wears off), and there is a time and financial cost in maintaining what you own.

What are the opportunity costs of the things you own?

Is the price worth paying?

What alternatives are viable for you?

5. Consider Under-indulgence

To achieve more happiness for your money, practise ‘under-indulgence’- indulging a little less than you typically do. By denying yourself excess, you can better savour and appreciate the finer things in life. Eating chocolate sparingly instead of excessively can make you enjoy it more. Live in a small house, and rent a huge luxury pad a few times a year; or drive a simple car daily, and hire a top of the range sports car sometimes, to really relish the experience. The comparative cost is far, far cheaper, yet the enjoyment is much greater than taking such possessions for granted. Plus – think of the time saved in having to manage and maintain all that expensive crap!

In which areas of your life can you under-indulge?

5. Collaborative Consumption

‘Collaborative consumption’ means sharing, swapping, bartering, trading or renting products, instead of ownership. In 2010, collaborative consumption was named one of TIME Magazine’s ‘10 ideas that will change the world’. The benefits of collaborative consumption are financial – saving costs or making money by hiring out your goods; environmental – reducing carbon footprints by sharing transportation and assets and social – Increasing happiness and contentment by networking and freeing up assets or money.

From the early days when Napster pioneered peer-to-peer music file sharing, subsequent new and increasingly ingenious platforms are appearing all the time in virtually every sector to facilitate the sharing of just about anything, from tools to cars to business jets.

Sell or share your own possessions – don’t fill up your attic and garage with stuff you rarely use. If you need anything, buy an item on Ebay; use it, and sell it the next day. If you are smart, you can sell it for more than you paid. You are an entrepreneur, after all! Even if you pay someone to manage the de-cluttering of your property, or the buying and selling process, the benefits of not keeping and maintaining all that stuff will be liberating. Not to mention the fact that you could then live comfortably in a property half the size!

6. Invest in Experiences over Assets

If you are going to spend money on yourself, you may want to switch from buying material objects (TVs or cars) to buying experiences (trips and special events). Psychologists’ research has proved that more satisfaction is derived from creating and enjoying memorable experiences than from possessing material possessions. Don’t ignore or delay your bucket list!

7. Invest in Learning

Don’t underestimate the value of learning. Time and money spent on developing yourself is well spent. Investing in ourselves: the development of our skills and knowledge, can have far higher returns for us than pensions or property. Learning new things makes most people happy – inspiring curiosity and interest – and there’s great satisfaction in achievement. Well-chosen investment in learning can lead to more opportunities and greater choices in life.

8. Spend Money on Others

In fact, for greater happiness, you are better off buying less in general and buying for other people instead. People who spend money on others rather than themselves are actually happier in the long run, with a sense of reward and satisfaction that enriches their feelings of sharing and contentment. Don’t forget that the same rules apply when you give your time or experiences, rather than material things – they usually mean more to the other person in the long run.

So – what action will you take to get off your hedonic treadmill?

Accept that ‘enough is enough’ for your own happiness, identify your priorities, set your goals and make life easier for yourself in the long term. Think: why buy when you can rent? Or, take it even further – why rent when you can borrow? Be smart – ignore the obvious, or what we’re conditioned to believe is ‘the’ way to do things. Think out of the box, and create new solutions for yourself.

Invest in time before it runs out, and it’s too late. Time is the only finite resource you have, so it deserves to be saved and invested well. Shake off the shackles of ownership, enjoy your liberty and use your time and resources to achieve what you want!

What can you get rid of?

What can you share?

How little do you actually need for optimal existence?

What changes will you make now?

What great things will you do with all that spare time and money?

If you would like to discuss this further – or you’d like some help from me to get you off the hedonic treadmill, please get in touch today and let’s talk!

Further Reading:

The Upside of Irrationality by Dan Ariely (Amazon Link UK, US)

The Four Hour Work Week by Tim Ferris (Amazon Link UK, US)

What’s Min is Yours: The Rise of Collaborative Cnsumption by Rachel Botsman and Roo Rogers (Amazon Link UK, US)

Steve Jobs – The Exclusive Biography by Walter Isaacson (Amazon Link UK, US)

If the above topic, or indeed any of my blogs are of interest to you, then contact me and let’s talk! Drop me an email at getintouch@marcwinn.com.

Buy Me a Coffee

Did you love this article? If so please consider buying me a coffee.

Take The 50 Coffee Adventure

A Fun, Light and Easy Way to Build Connections

Or search your local Amazon store for "The 50 Coffee Adventure".

This is too motivational. thank you. I enjoyed your post. I will follow your advice pal.

Very nice read,thanx

Definite eye opener and motivater to learn more. Changing a way of thinking expands our world and the possibilities in it!