In my experience, very few people have even contemplated – let alone planned for – a scenario in which their currency slumps and the public lose confidence. Although such events are rare, they do happen; usually after a prolonged attempt to fix an already-failed financial system. If that sounds familiar, it should set off alarm bells.

My credibility for prediction stems from my forecast of the 2008 crash, even down to the correct year. One statistician I met was visibly upset that I had not utilised a mathematical model to make the prediction, but he was missing the point. While I have 25 years of experience in managing people’s money, that alone makes me no different from millions of other financial folk. What sets me apart is an overlap with many disciplines, including science and history.

Another inspiration was the 1960 film version of HG Wells’ The Time Machine, which portrayed a time traveller speeding back and forth through the past, present and future. Without the benefit of a time machine, I use my knowledge of previous crises to perform a meditative role-play, imagining how a similar scenario might pan out in a modern setting. It aids mental toughness and prepares one to deal with the classic human reactions of fright, flight and fight. Companies likewise practise Disaster Recovery programmes to overcome calamities that compound each other when panic and time pressures converge.

Why is planning relevant to currencies?

Whilst there is not much we can do about natural disasters, we can at least put some thought into financial ones.

Examples of currency crises include Germany’s hyperinflation in 1923, when prices spiralled up in a matter of months. Farmers stopped delivering food to cities, because the money they received was worthless by the time the goods were delivered. Middle-class savers became destitute, as did pensioners living off a fixed income, making them utterly impoverished. Those who had illegally hoarded foreign currency lived a life of extravagance, buying treasured antiques at bargain prices. Such social discontent later played into the hands of extremist politicians; the outcome of which is seared into our minds.

Further back in time, the money that flowed from Rome dried up as the legions pulled back from the periphery of the realm. Having been seamlessly connected with the Empire, Britain then descended into the Dark Ages. Many towns were abandoned as commerce contracted and swathes of the population reverted to a rural lifestyle in small communities. It would be five centuries before a consistent coinage system circulated across the country.

So where does this leave us now? If anything, we are at greater risk from a currency collapse than ever. In spite of massive sums thrown at our financial system, it has spectacularly failed to deliver benefits to the wider population. Global trade flows are shifting, because American rhetoric and sanctions have goaded China and Russia. It is only natural that they cease to use the US Dollar as a medium of exchange for trade. In the past, the dollar has strengthened in times of turmoil, owing to its safe haven status. Next time could be different. Russia and China have been scrambling to buy gold bullion and may underpin their currencies with precious metals in future.

So how does this affect us in practical terms? We know that supply chains are co-dependent. This was tragically demonstrated when a Japanese earthquake caused a meltdown at a nuclear reactor in 2011. Many electronic items could not be produced, for want of missing components. Future financial failure could have a similar effect. Over the course of a century, western countries have switched from self-sufficiency to reliance on imports for both finished goods and raw materials. We are therefore poorly prepared for a reversal of globalisation: into isolation.

Insularity need not be as negative as past experience suggests. Small communities such as those on my island home are well placed for domestic self-reliance, since technology opens up opportunities in power production, agriculture and 3-D printing. It does, however, need thought and preparation to put a Plan B for your family and community into place when most needed. So-called Doomsday Preppers in America may well have the last laugh, since they have been hoarding food, guns and medicines. But this smacks of selfishness. If communities act together – as they always have done, in past crises – then better solutions can be sought.

Fortunately, here in Guernsey we are ahead of the game and have launched the Dandelion Project to solve issues too unwieldy for large countries to attempt. This is not a group of hippy daydreamers, but serious people across a spectrum of professions.

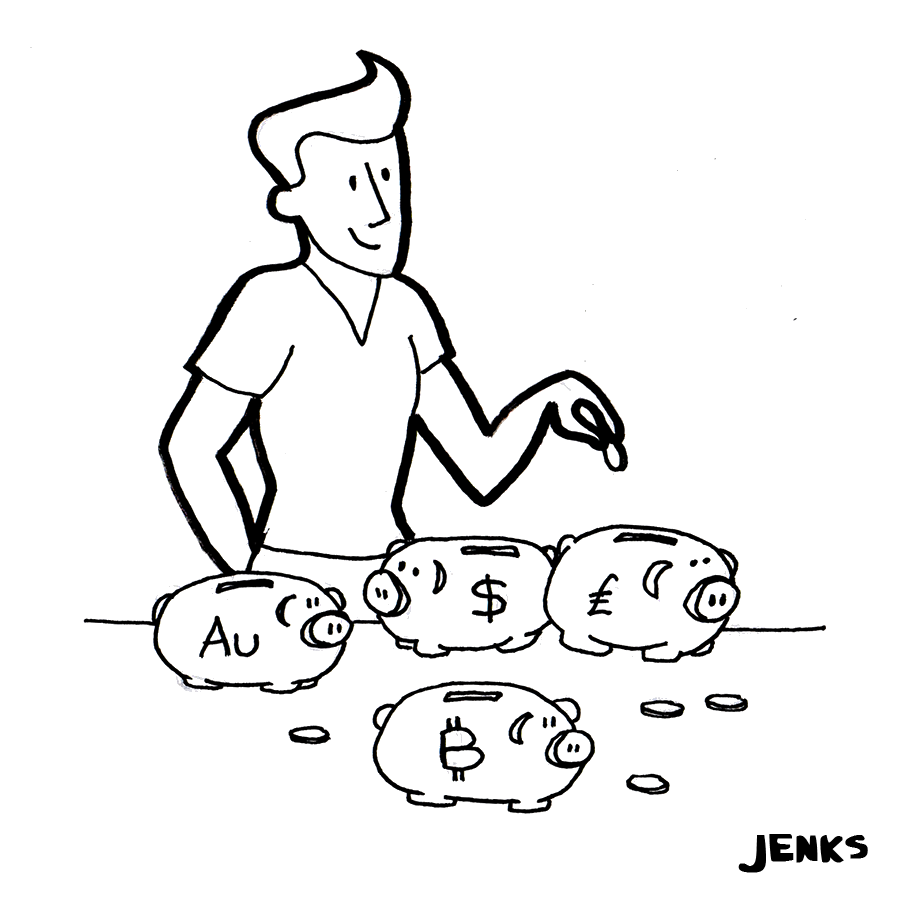

I have read enough history to be fearful of what could happen to my family in a worst case scenario and have made some preparations to cover myself in the event of a future slump. Buying gold and silver are obvious starting points, but I have also taken time to understand new digital forms of money such as cryptocurrencies. Technology can liberate us, through decentralisation and self-empowerment, so time invested like this is well spent. Many of us here are taking up useful hobbies such as animal husbandry and horticulture to be prepared for the unexpected, and having fun in the meantime, learning old-fashioned skills with a modern twist.

In the short-term, however, a currency crisis is highly stressful and disruptive. Unlike the Dark Ages we can probably adapt within five months rather than five centuries, but it will not be a smooth handover.

Anyone seeking advice should first learn lessons from the past by reading When Money Dies by Adam Fergusson (1975). To find tips on which businesses and assets would thrive, I would recommend The Death of Money by James Rickards (2014).

Before writing off these thoughts as the musings of a madman, please take a moment to consider a Plan B for your family and community.

The cost of a currency collapse is most definitely human. Make sure you are the victor and not its victim.

- Have you prepared for currency collapse?

- What are you holding onto in life?

- What if it was worthless when you needed it?

- What do you need to do, to make sure that you and your community are prepared for this brave new world?

Notes from Marc

Toby Birch is a former mentee of mine and is Guernsey’s answer to Nicholas Taleb. A truly brilliant mind, Toby wrote the book The Final Crash in 2007 predicting the financial crash in 2008. Many things I do now are a direct result of seeing what could happen in inevitable global currency collapse. I have Toby to thank for that knowledge.

Buy Me a Coffee

Did you love this article? If so please consider buying me a coffee.

Take The 50 Coffee Adventure

A Fun, Light and Easy Way to Build Connections

Or search your local Amazon store for "The 50 Coffee Adventure".

Love it as always. Time to stack up on beans and rice. 🙂

hi Toby

What are your predictions for timing of the next crash? While I understand a black swan event could happen anytime it looks like quantitive easing could extend the normal boom cycle. I have silver, Bitcoin and a forex account to short the markets.

just checking out the hate it part. You cannot hate it. get a life. Drink suspended coffee. caffeine overdose not ok but on tap. xxxx